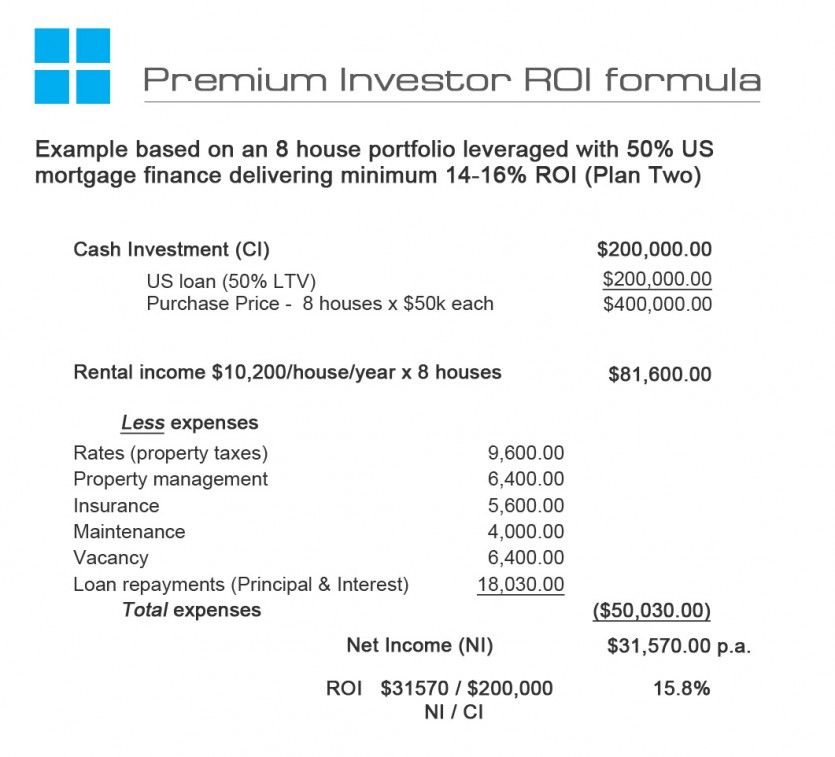

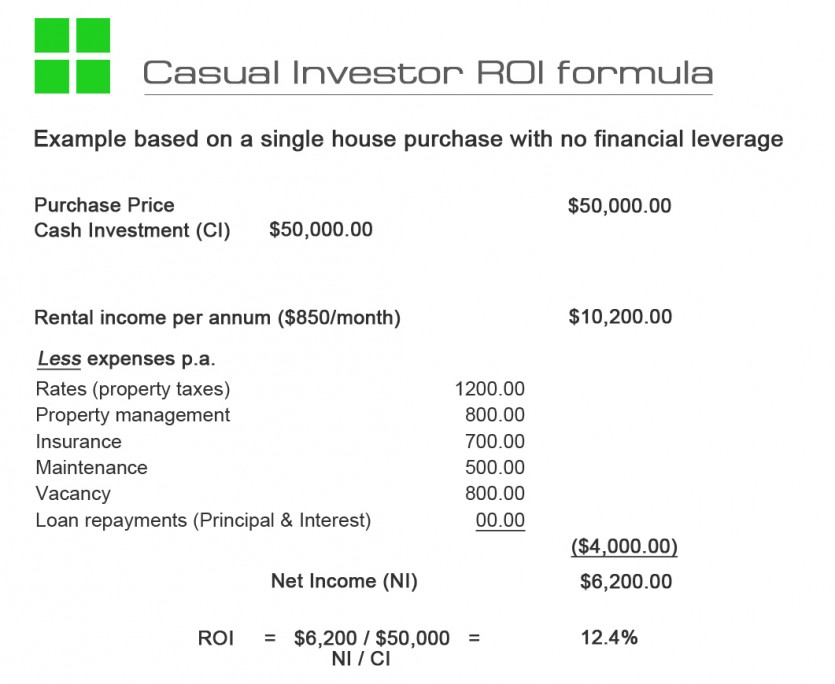

Our ROI formula

There does not seem to be an industry standard for calculating the ROI based on the properties’ income. So for the sake of clarity, we calculate our ROI's using the following formula/example.

* This is the price paid to buy the property, but excludes any legal and accounting fees associated with the purchase.

A common expression in the US is a 'cash on cash' return which we use on this website from time to time and means the return on your equity (or cash invested). For example if you put $100K into a property, borrow $300K and earn $25K P.A in rent, then your cash on cash return is 25/100 = 25%. We more commonly term this as leverage and tie it in with the abbreviation LTV (or LVR) to express the ratio of money borrowed to the purchase price or value of the property. Our connections with the US bank play an essential role in our property investments as they enable us to offer higher yields through leverage (here) to our Investors and they offer an essential cross-check on the long-term viability of each property (here).

.